A chart of accounts (COA) is a list of all the accounts you must use to record financial transactions in your general ledger.

It helps you keep track of where money comes from and goes.

A chart of accounts is integral to your bookkeeping, accounting, and financial reporting.

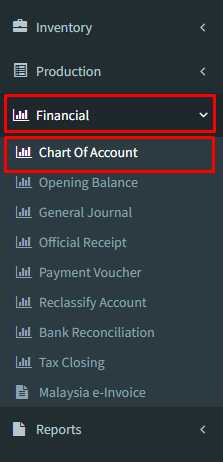

Step 1 : Click on side menu >> Financial >> Chart of Account

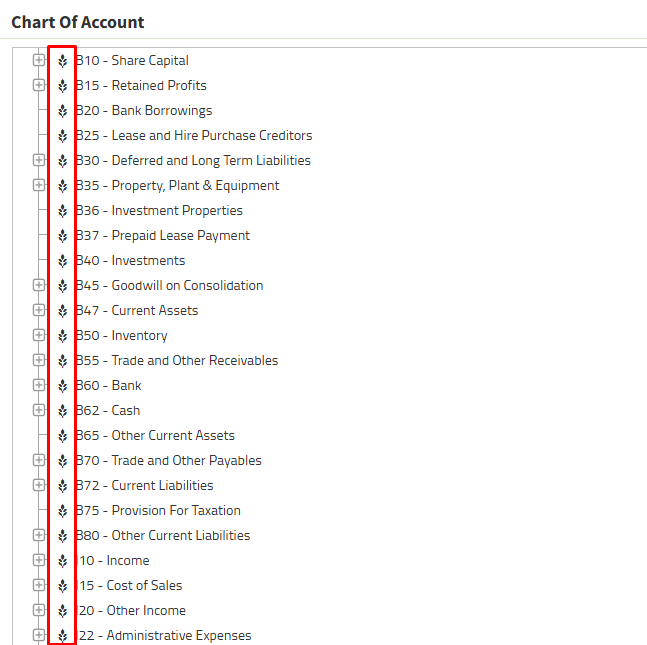

Step 2 : Those accounts with “flower” icons are the main or parent account and this account cannot be changed.

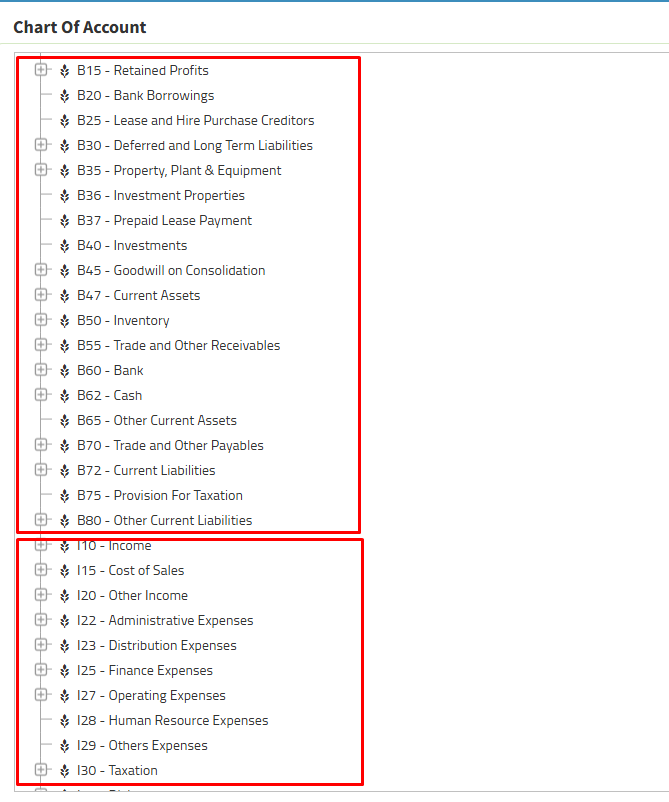

Step 3 : There are 2 different categories

“B” stands for Balance Sheet and “I” stands for Income Statement

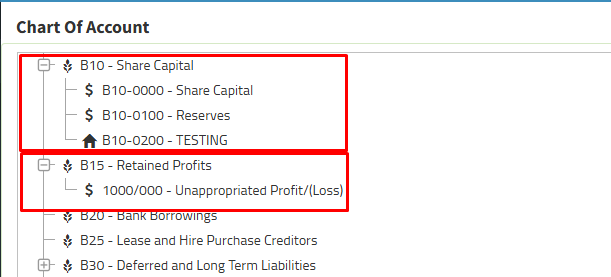

Step 4 : “B10” >> Share Capital : It refers to the amount of money the owners of a company have invested in the business as represented by common.

“B15” >> Retain Profit : The amount of profit a company has left over after paying all its direct costs, indirect costs, income taxes and its dividends to shareholders.

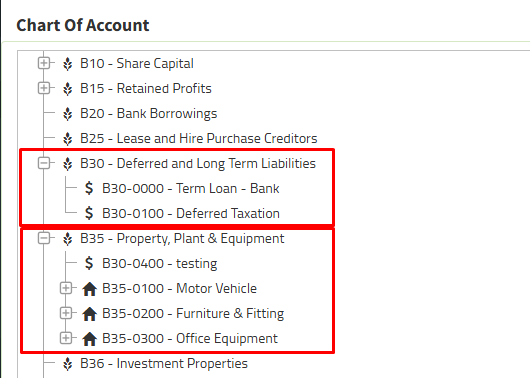

Step 5 : “B30” >> Deferred and Long Term Liabilities : It refers to previously incurred liabilities that are not due within the current accounting period.

“B35” >> Property, Plants and Equipment : It’s anything that a business has legal title over. Basically there are 2 types of assets of this account, cost and accumulated depreciation.

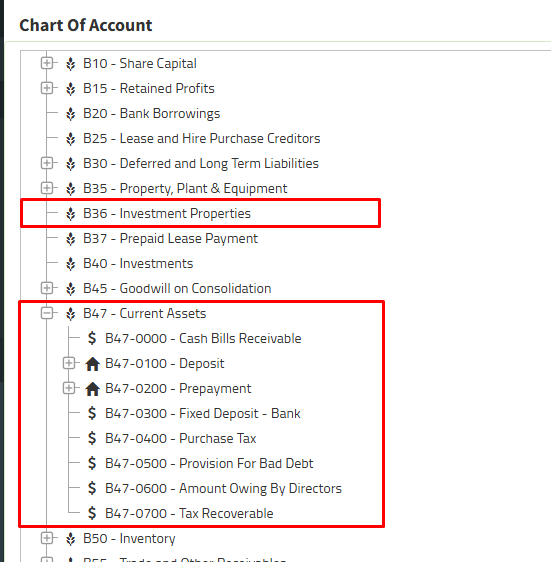

Step 6 : “B36″ >> Investment Properties : It a property that a company holds to earn rental income and/or capital depreciation.

“B47” >> Current Assets : It’s a short term asset that a company expects to use up convert into cash or sell within one or more operating cycles.

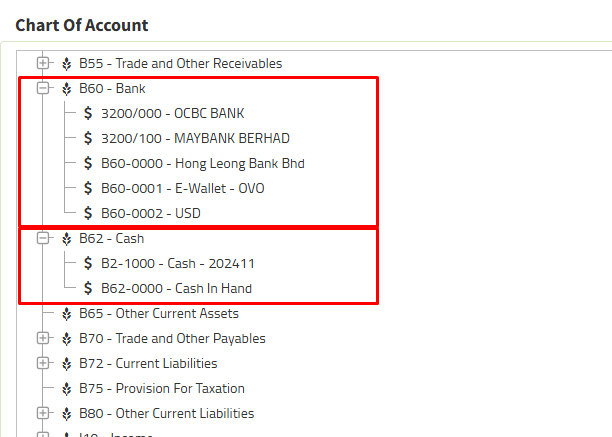

Step 7 : “B60“ >> Bank : You can add one or more your bank accounts under this account.

“B62” >> Cash : It’s the amount of money a company currently has available. This money to kept on hand to offset any unplanned cash outflows.

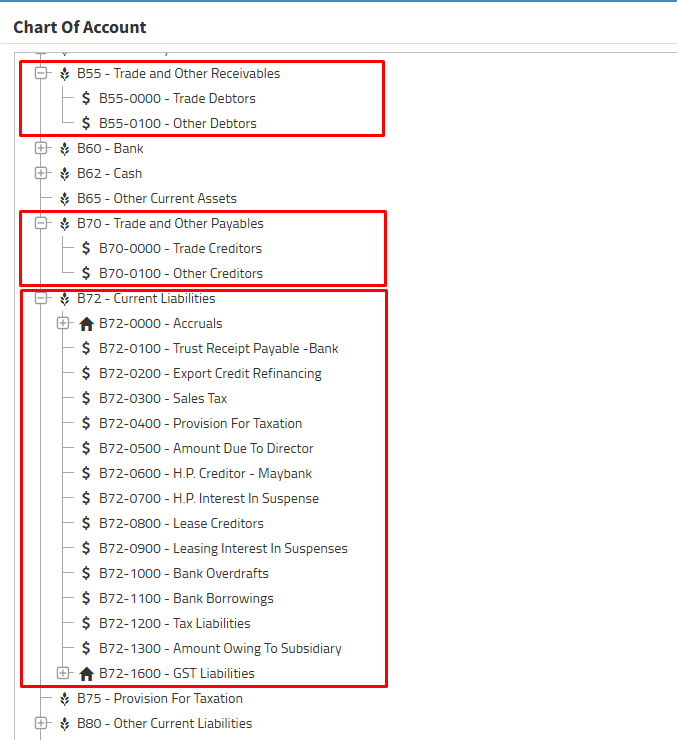

Step 8 : “B55“ >> Trade and Other Receivable : It’s trade for debtors, the funds that customers owe your company for products or services that have been invoiced.

“B70” >> Trade and Other Payable : It’s trade for creditors represents the amount that a company owes to it’s creditors and suppliers.

“B72” >> Current Liabilities : The debts a company owes must be paid within one year.

Step 9 : “I10“ >> Income : The total amount of money a company earns from selling a product or service.

“I15” >> Cost of Sales : It indicates how much a retail or wholesale business spends on the products it purchases from suppliers for re-sale.

Step 10 : “I20“ >> Other Income : The total amount of money a company earns apart from selling a product or service.

“I22” >> Administrative Expenses : It’s all costs that relate to regular business operations. You can insert all business costs on this account.

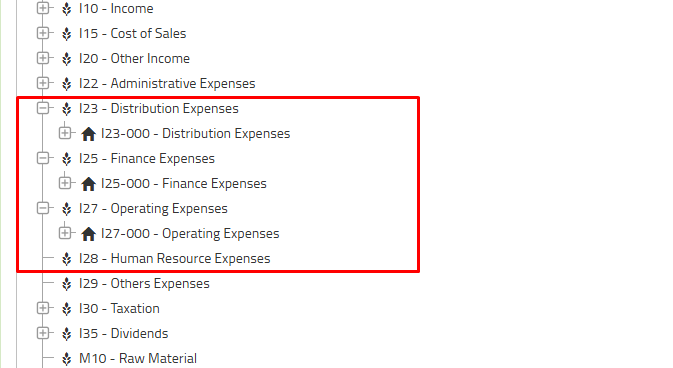

“I23, I25, I27 and I28” >> Basically the same as administrative expenses.

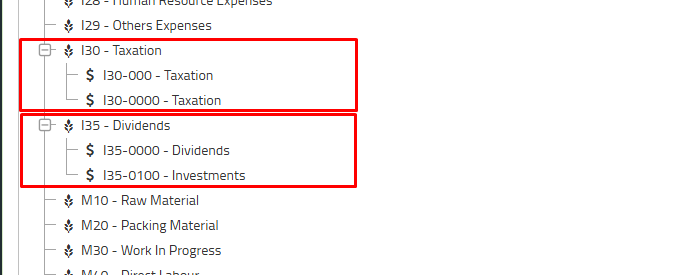

Step 11 : “I30“ >> Taxation : It’s for tax purposes.

“I35” >> Dividends : It’s a portion of a company’s earnings that it returns to investors usually as a cash payment.

Powered By : SKYBIZ ®