SECTION B1 : SKYBIZ E-Invoicing Update Company Information & Validate Taxpayer TIN ( Offline ) Update Version

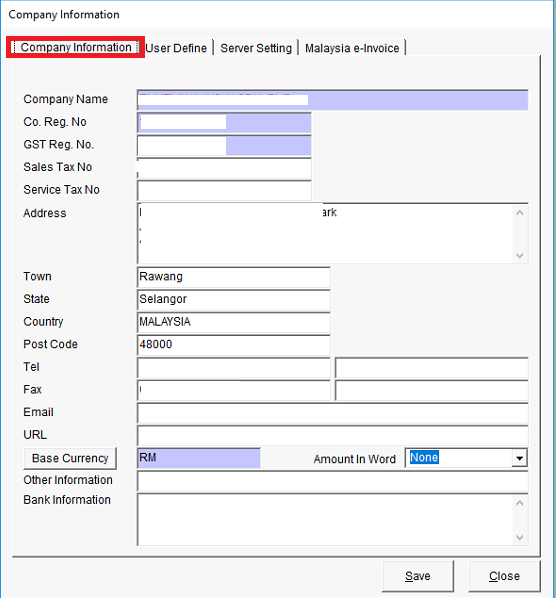

Step 1 : Update Company Information >> go to [ Company Information ] You are required to update some additional information on your company module as per below listed

a. Company Name

b1. Business Registration No ( Current ) :

b2.Business Registration No ( New ) :

c. Company Business Address : ( compulsory fill up Town, Country, State, Postcode )

https://sdk.myinvois.hasil.gov.my/codes/countries/

https://sdk.myinvois.hasil.gov.my/codes/state-codes/

d. SST Registration No.: ( compulsory if customer is SST registered, else put N/A if Not Available )

e. Tax Identification Number (TIN) : https://www.hasil.gov.my/media/1iblexbc/malaysia-tin.pdf

f. E-Invoice Contact No. : (compulsory fill up)

g. E-Invoice Contact Email Address : (compulsory fill up)

h. Tourism Tax No : ( compulsory if supplier is Tourism Tax registered, else put N/A if Not Available )

i. MSIC Code: https://sdk.myinvois.hasil.gov.my/codes/msic-codes/

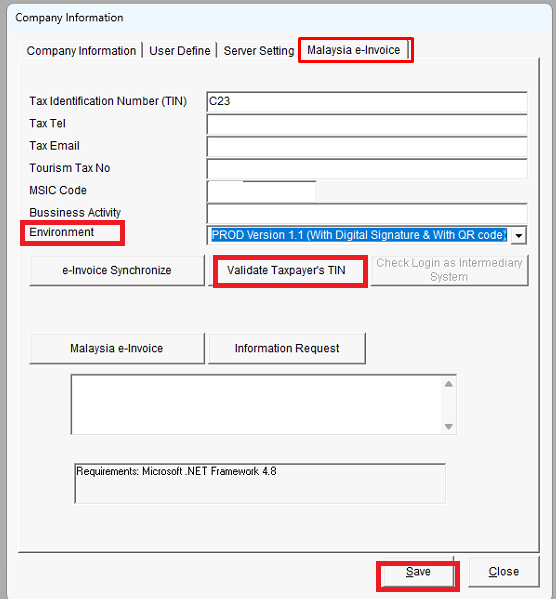

Step 2 : After fill up all the company information, go to [ Malaysia e-Invoice ] and click [ Validate Taxpayer’s TIN ] and [ Save ]