Introduction to SKYBIZ E-Invoice

The e-Invoice is a digital version of a traditional paper invoice, and the Malaysia e-Invoice was introduced by the Inland Revenue Board of Malaysia (LHDN) as part of the country’s tax digitalization initiative. It is designed to streamline business transactions and improve tax compliance by allowing invoices to be created, transmitted, and validated electronically in real time through the LHDN system. An e-Invoice contains all the essential information found in a standard invoice but is issued and stored digitally. Once submitted, each e-Invoice is validated by LHDN and assigned a unique identification number (UUID). This system ensures data accuracy, reduces fraud, enhances transparency, and simplifies reporting for both businesses and the tax authority.

A Consolidated e-Invoice is a type of electronic invoice that combines multiple transactions or sales made to the same customer within a specific period into a single document. This approach is particularly useful for businesses that handle a high volume of low-value or frequent transactions, such as retailers, restaurants, or service providers. In the Malaysia e-Invoice framework introduced by LHDN, a consolidated e-Invoice allows businesses to simplify reporting by summarizing all individual sales to a single buyer under one collective e-Invoice submission. It includes key information such as transaction dates, total sales amounts, taxes, and customer details. This helps reduce administrative workload, prevent duplication, and maintain organized records while staying compliant with tax reporting requirements.

How to Consolidate e-Invoices?

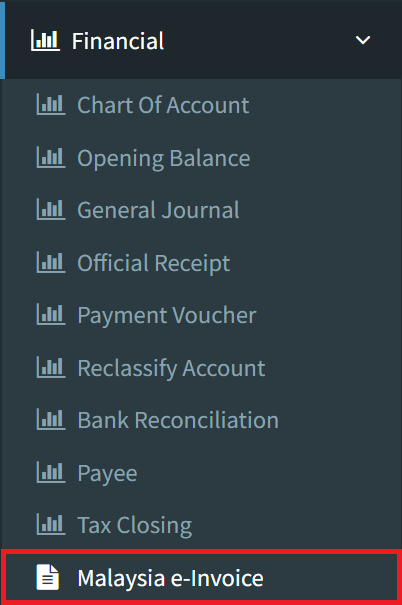

Step 1: To consolidate e-Invoice, navigate to Financial > Malaysia e-Invoice

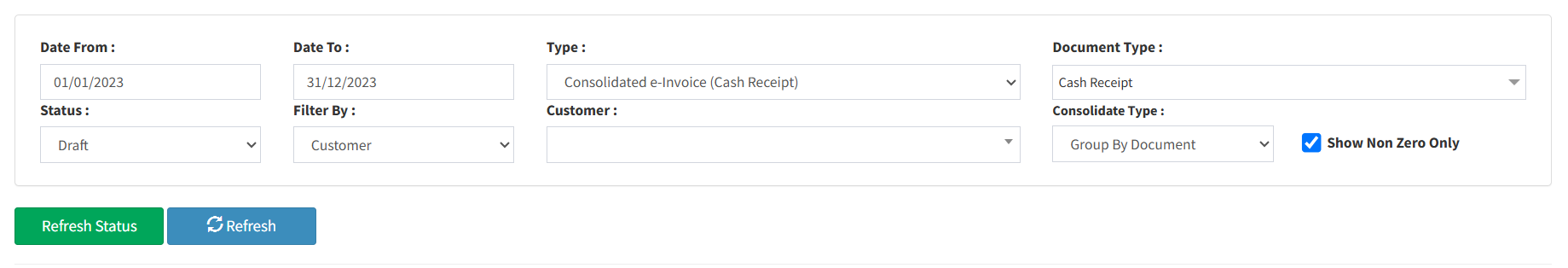

Step 2: Select Consolidate e-Invoice as the Type, and you can filter the document by date, document type, or status. After that, click the Refresh button.

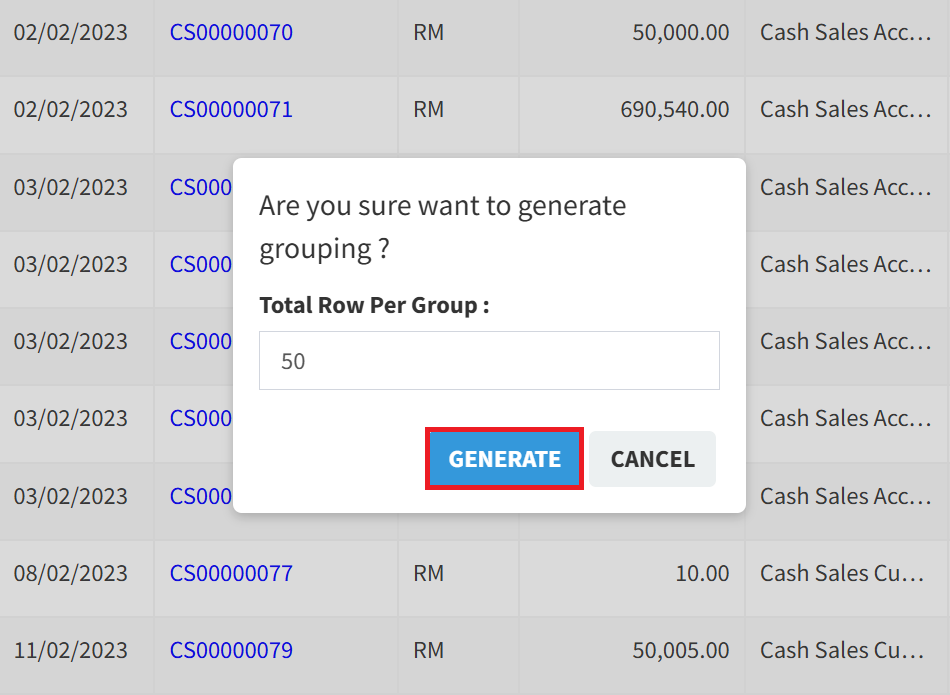

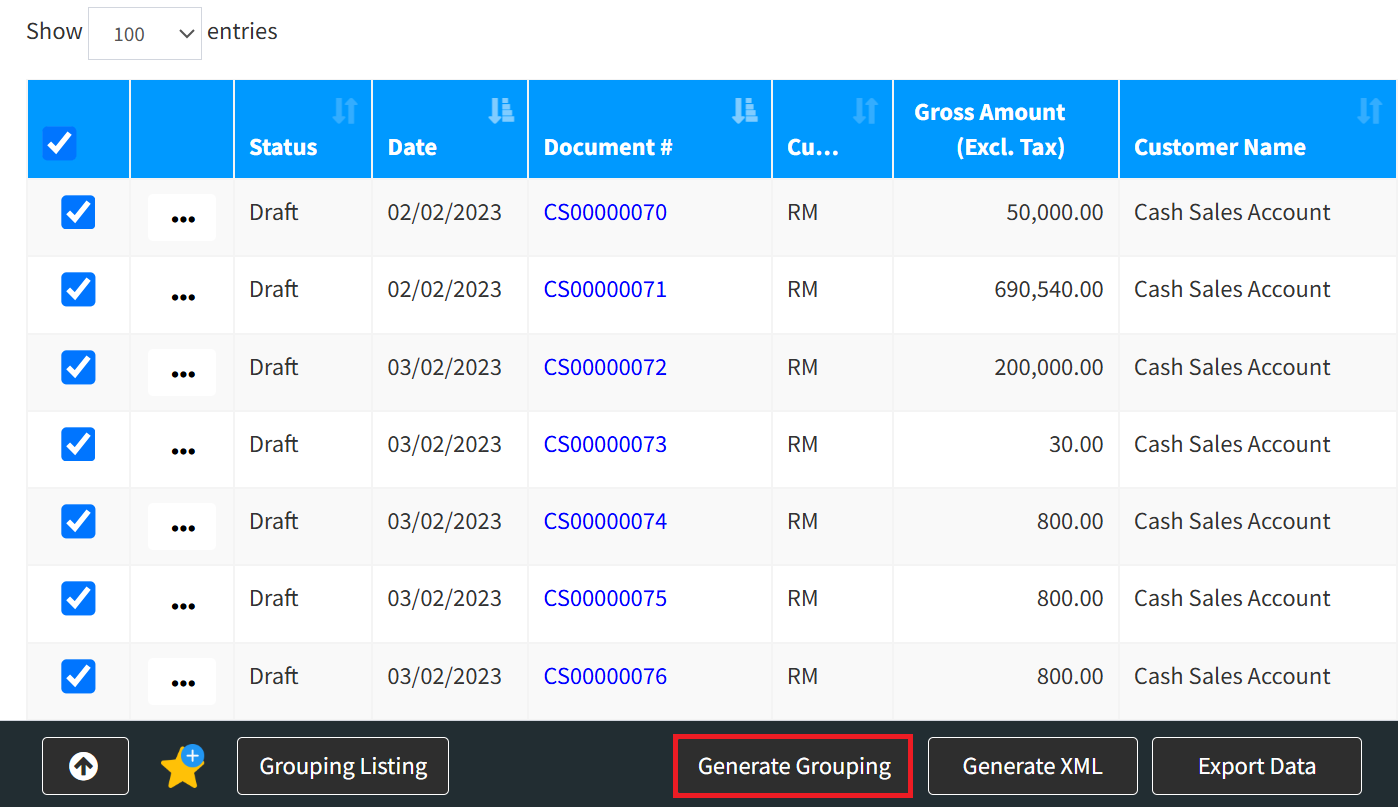

Step 3: Select the document you want to submit to Malaysia e-Invoice, then click the Generate Grouping button to group your document before submitting.

Step 4: Enter the total number of transactions per 1 consolidated e-Invoice (50 is recommended), then click the Generate button.

Step 5: Click the Grouping Listing button to see all Consolidated e-Invoices.

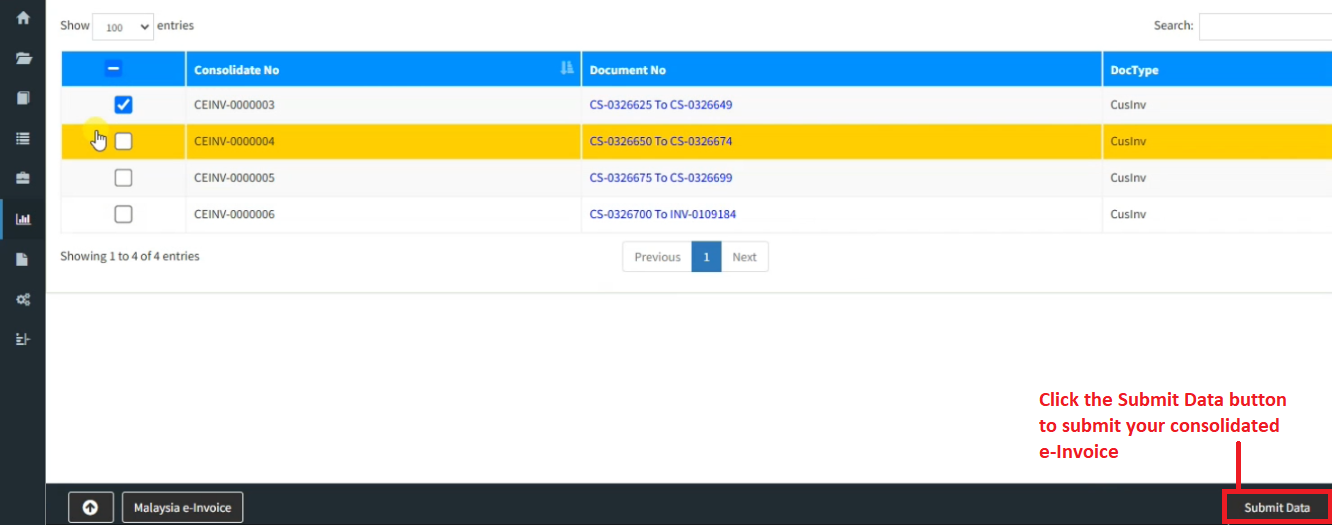

Step 6: Select the Consolidated e-Invoices, then click the Submit Data button.

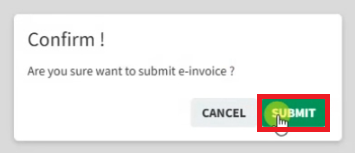

Step 7: Click the Submit button to continue submitting your consolidated e-Invoice.

Conclusion

In conclusion, the Malaysia e-Invoice system represents a major step forward in modernizing and digitalizing the nation’s tax and accounting processes. By enabling real-time validation and secure digital submission of invoices, it enhances transparency, accuracy, and efficiency for both businesses and the LHDN. The implementation of e-Invoicing helps reduce errors, prevent tax fraud, and streamline compliance procedures. Ultimately, adopting the Malaysia e-Invoice supports better financial management, strengthens business credibility, and aligns organizations with the future of digital taxation.

The consolidated e-Invoice is an efficient solution for businesses managing numerous small transactions. By grouping multiple sales into one digital document, it streamlines the e-Invoicing process, saves time, and reduces administrative complexity. It also ensures accuracy and compliance under LHDN’s e-Invoicing system, supporting smoother tax reporting and better data management. Overall, the consolidated e-Invoice promotes efficiency, accuracy, and ease of compliance for high-volume business operations.

Powered By: SKYBIZ ®