Below are Guideline(s) on How to Set Default Tax Code On Maintenance

** Make sure user id set as Tax Authorised Person Y/N**

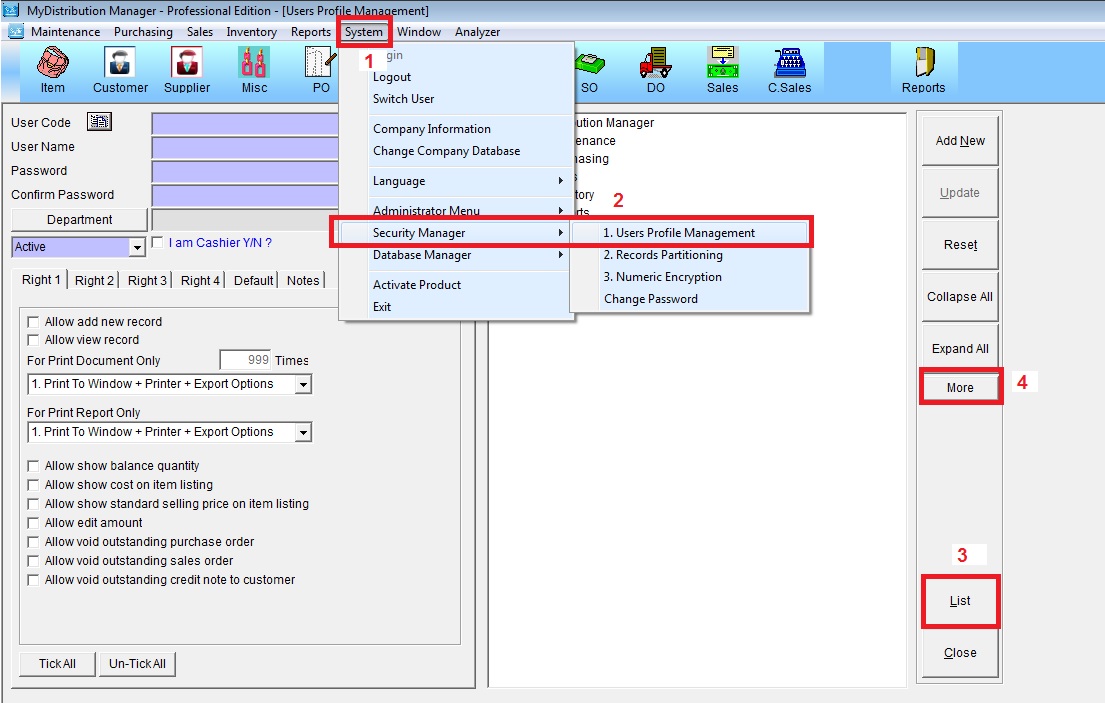

Step 1:

- 1.Go to System

- 2.Security Manager >User Profile Management

- 3.List (select user id)

- 4.More

Step 2: Scroll down

- 5.Tick Number 150 (Tax Authorised Person Y/N)

- 6.then Update

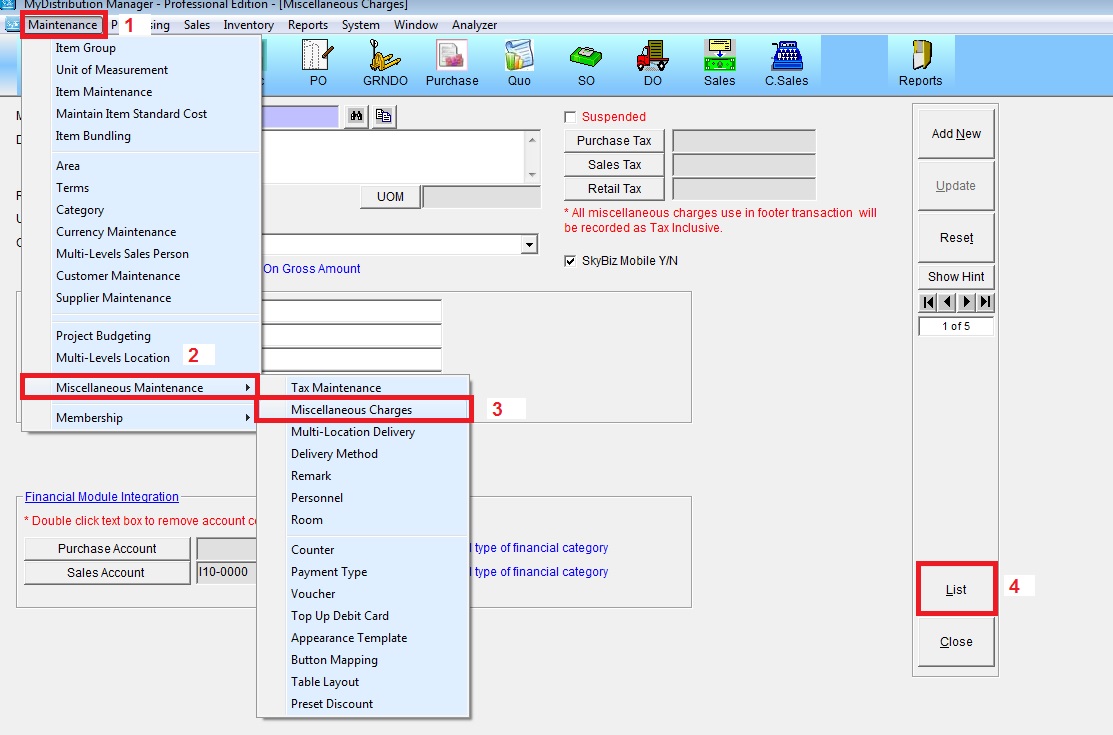

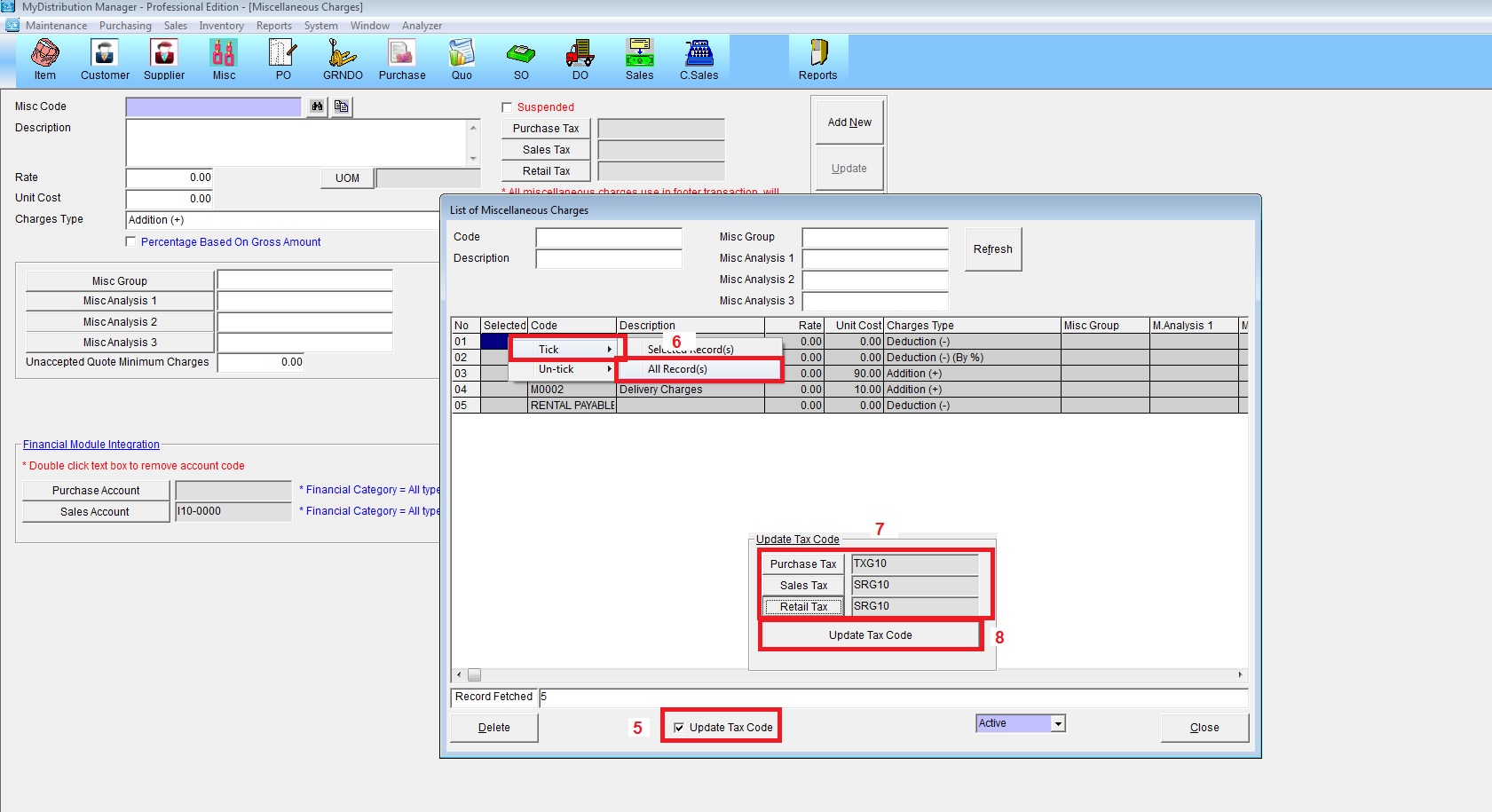

** Guides to Update Miscellaneous Charges Tax Code

- 1.Go to Maintenance

- 2.Miscellaneous Maintenance

- 3.Miscellaneous Charges

- 4.List

- 5.Tick Update Tax Code

- 6.right click to Tick All Records if all Miscellaneous Charges use 1 Tax Code/Rate

- 7.Select Purchase Tax and Sales/Retail Tax

- 8.Update Tax Code

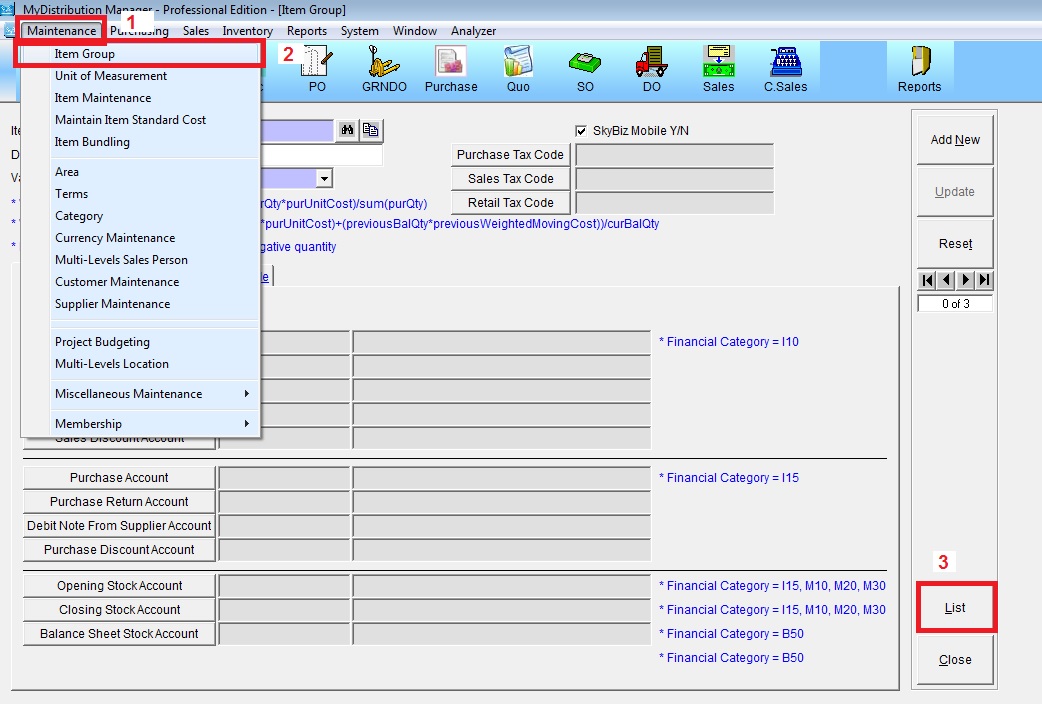

“Setting Default Tax Code for Item Group and Item Maintenance”

Scenario 1: If your System Tax Code selection based by Item Group/Miscellaneous

- 1.Go to Maintenance

- 2.Item Group Maintenance

- 3.List

- 4.Tick Update Tax Code

- 5.Select Purchase tax and Sales/Retail Tax Code

- 6.right click to Tick All Records if all item will use 1 Tax Code/Rate

- 7.Update Tax Code

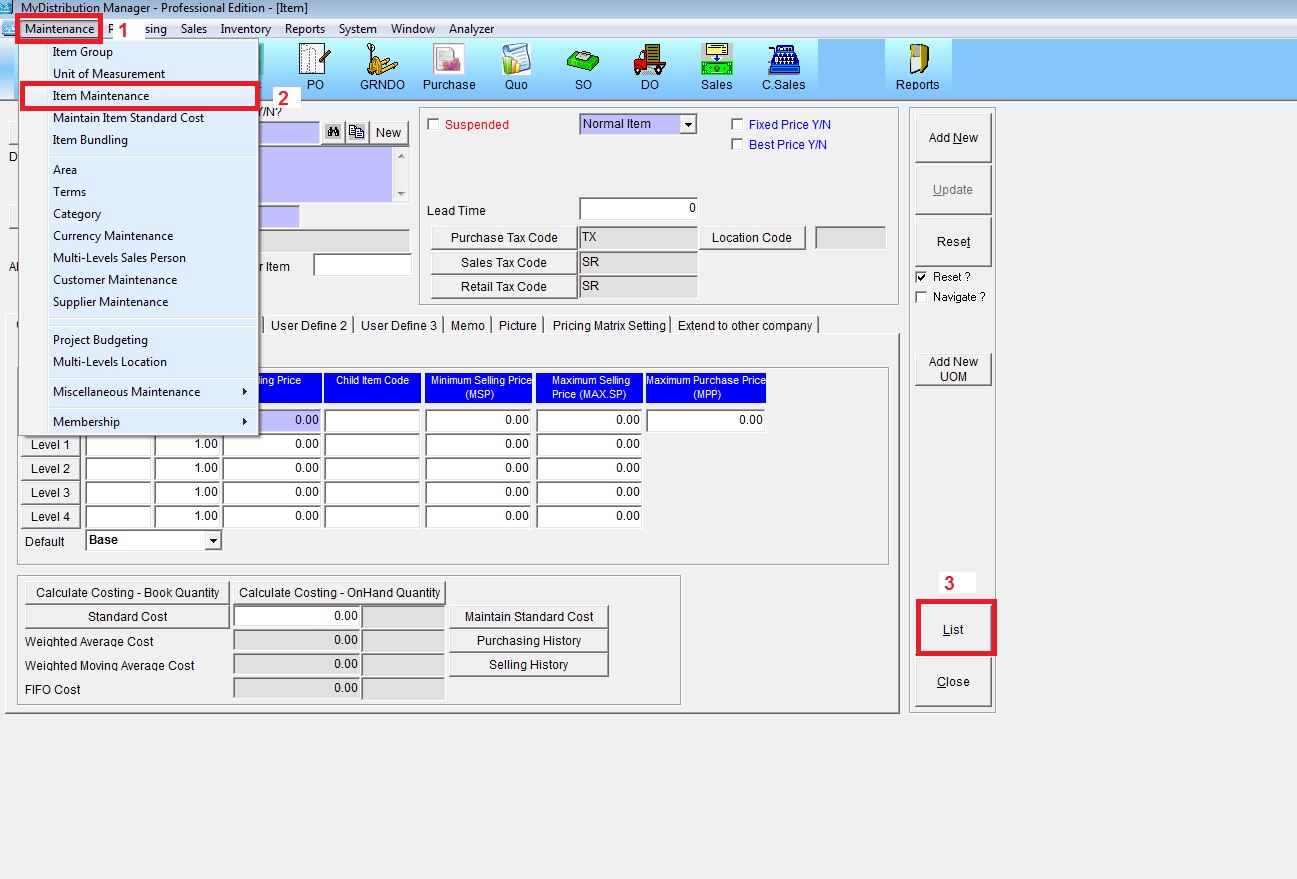

Scenario 2: If your System Tax Code selection based by Item/Miscellaneous

- 1.Go to Maintenance

- 2.Item Maintenance

- 3.List

- 4.Key in Max Records (99999) then Refresh

- 5.tick Update Tax Code

- 6.right click to Tick All Records if all item will use 1 Tax Code/Rate

- 7.Select Purchase Tax and Sales/Retail Tax Code

- 8.Update Tax Code