Why this intergation matters :

– Sync Exely transaction to Skybiz for SST and E-invoice submission

– Real-time invoice generation and transmission.

– Compliance with LHDN standards.

– Secure and enrypted data handing.

– Seamless integration with Skybiz Cloud Accounting.

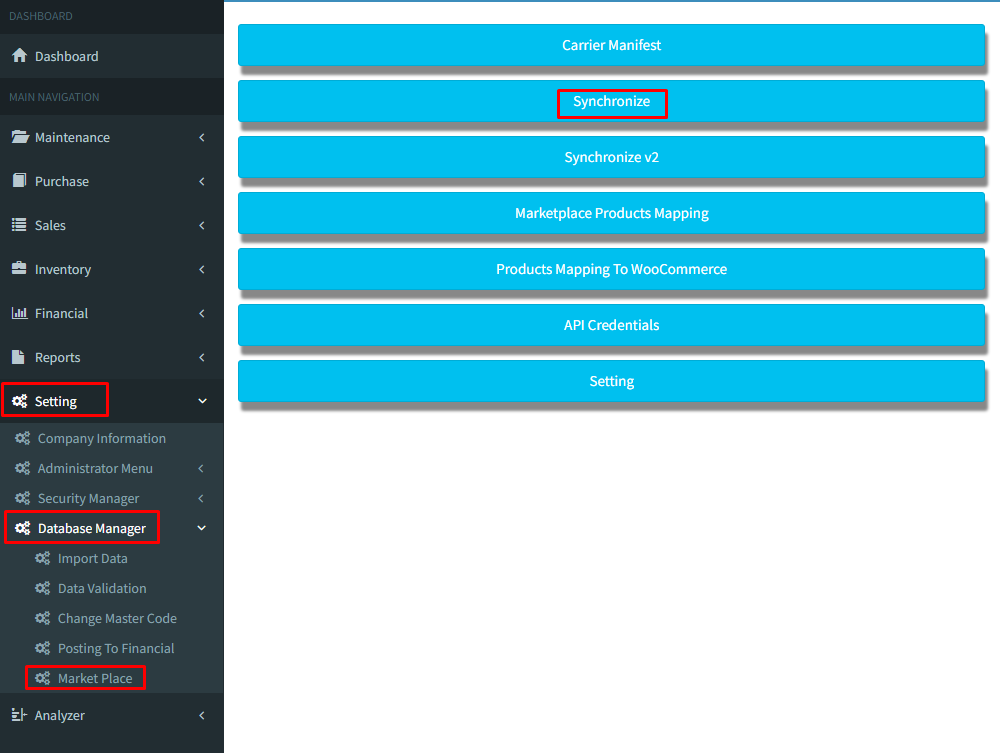

01 :The first one is show you how system synchronization work’s between Exely VS Skybiz system.

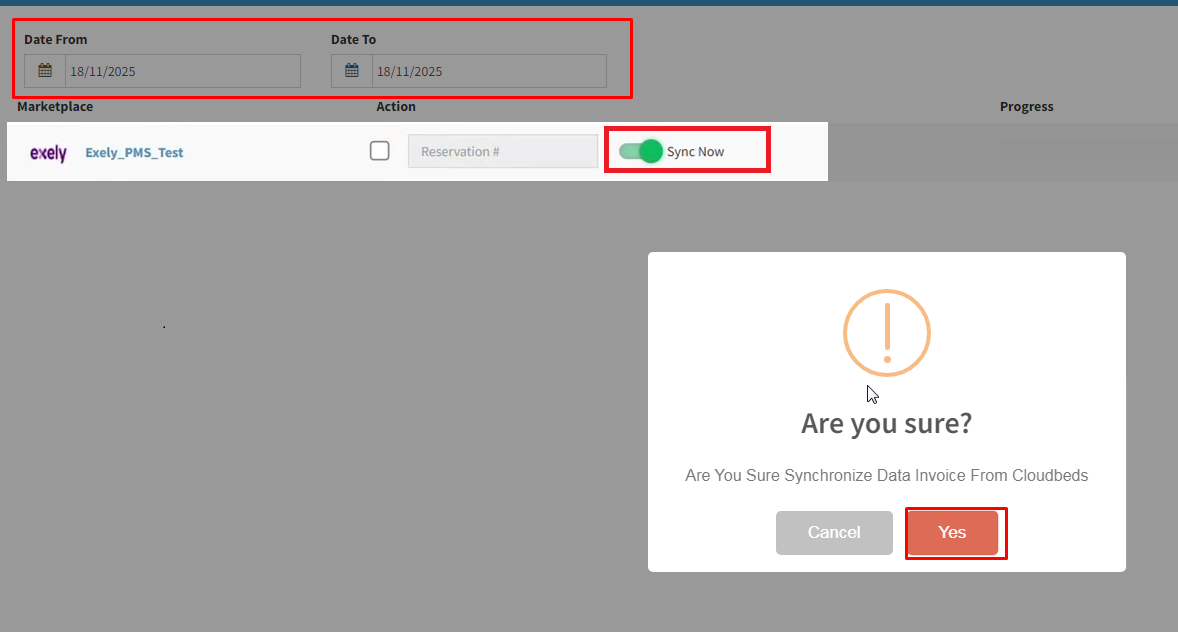

1a: At menu Setting >>> Data Manager >>> Markrt Place >>> Synchronize

1b: Choose the date range that you want to sync >>> Sync Now >>> Yes

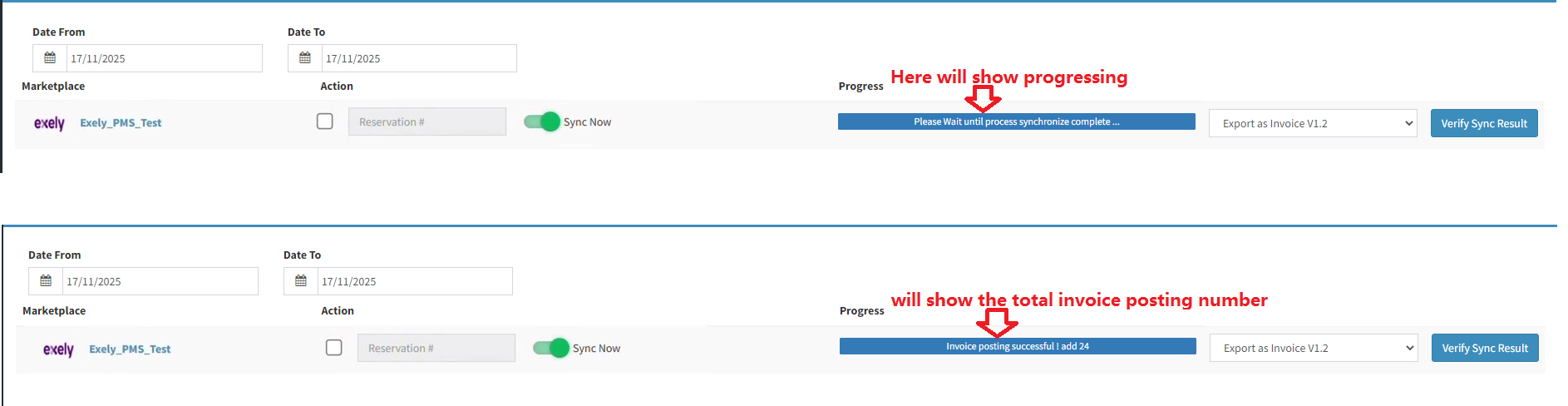

1c: Here will show progressing and will show the total invoice posting number

02: Please log in to SkyBiz Cloud to run the synchronization.

https://clouderp.biz.my/

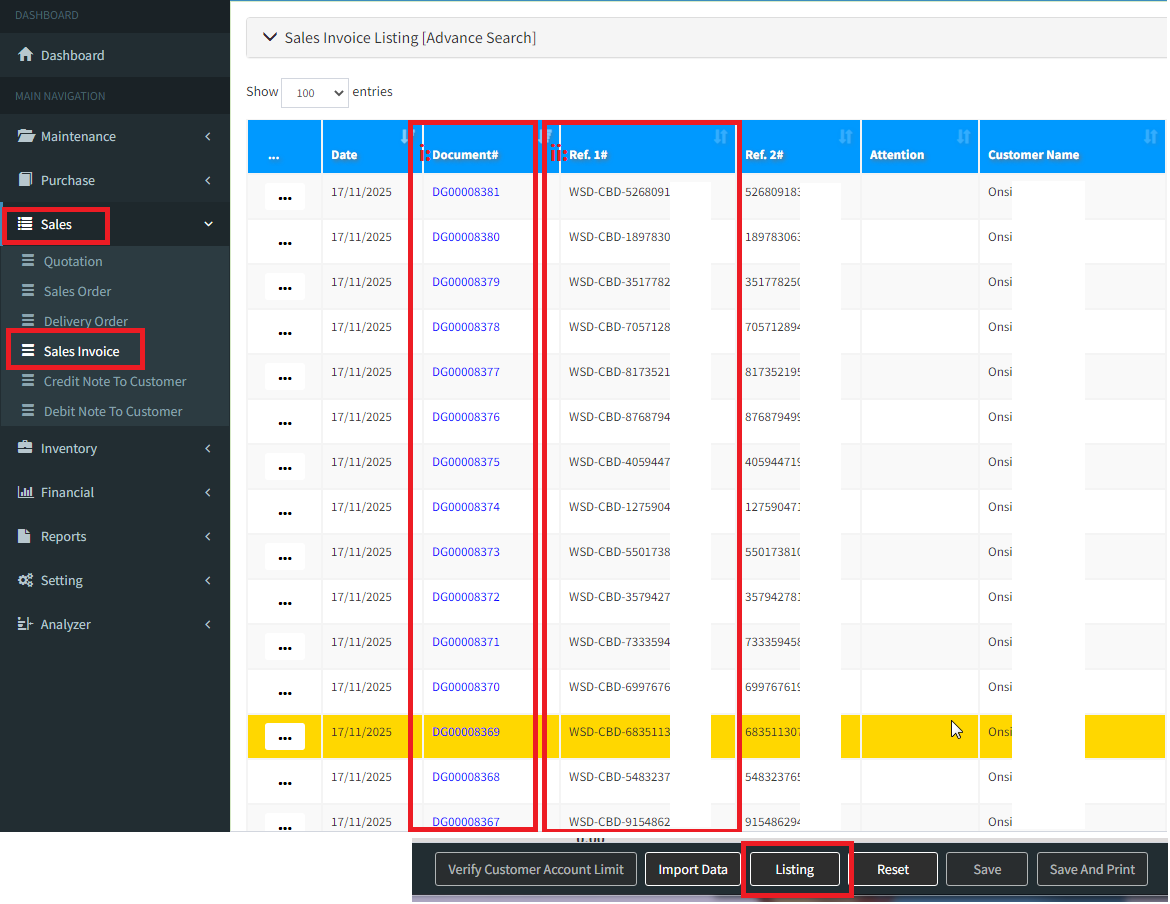

03: We will show you how the transaction appear in the SKYBIZ Sales Invoice listing.

3a :At menu go to Sales >>> Sales Invoice >>> Listing

i :This document number is SKYBIZ invoicong number, which will also be treated as accounting invoice number.

ii:This reference number is Exely reservation number or booking number.

04 :Add intermediary

05: Submit Standard eInvoice

06: Submit Consolidate eInvoice (for Cash Sales unable to provide TIN number)

Malaysia E-Invoice – Consolidated e-Invoice

07. (for retailer businesses allow their cash sales customer to submit TIN information after sales and allow an option self-service E-Invoice submission)

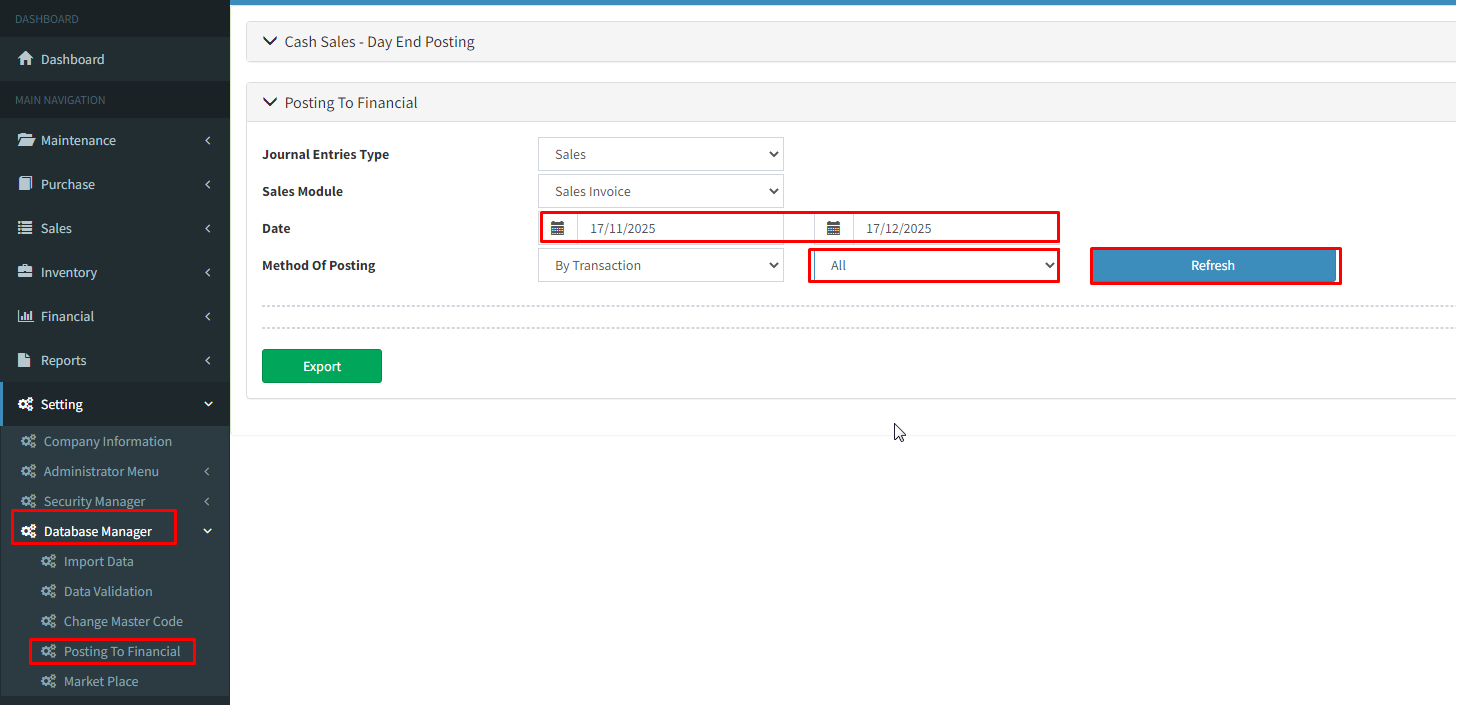

08: Furthermore, we show you how Exely transactions can be integrated into Skybiz accounting to generate financial report and SST reports.

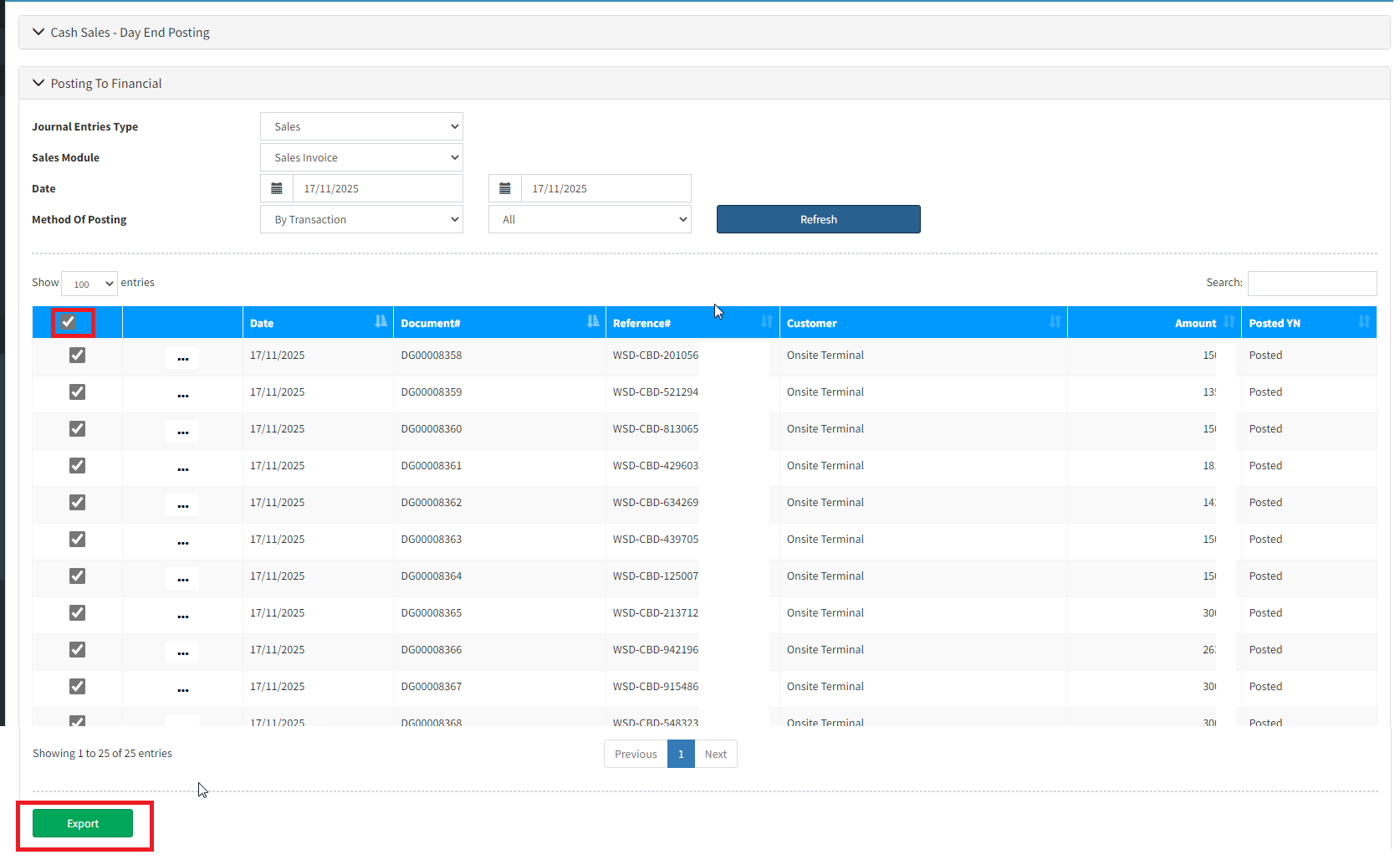

8a: At menu go to setting>>> Database manager>>> Posting to financial

i: Choose the date that same range that you sync.

ii: Click for all method

iii: press the [Refresh] button.

8b :Tick all the invoice and press the [Export] button.

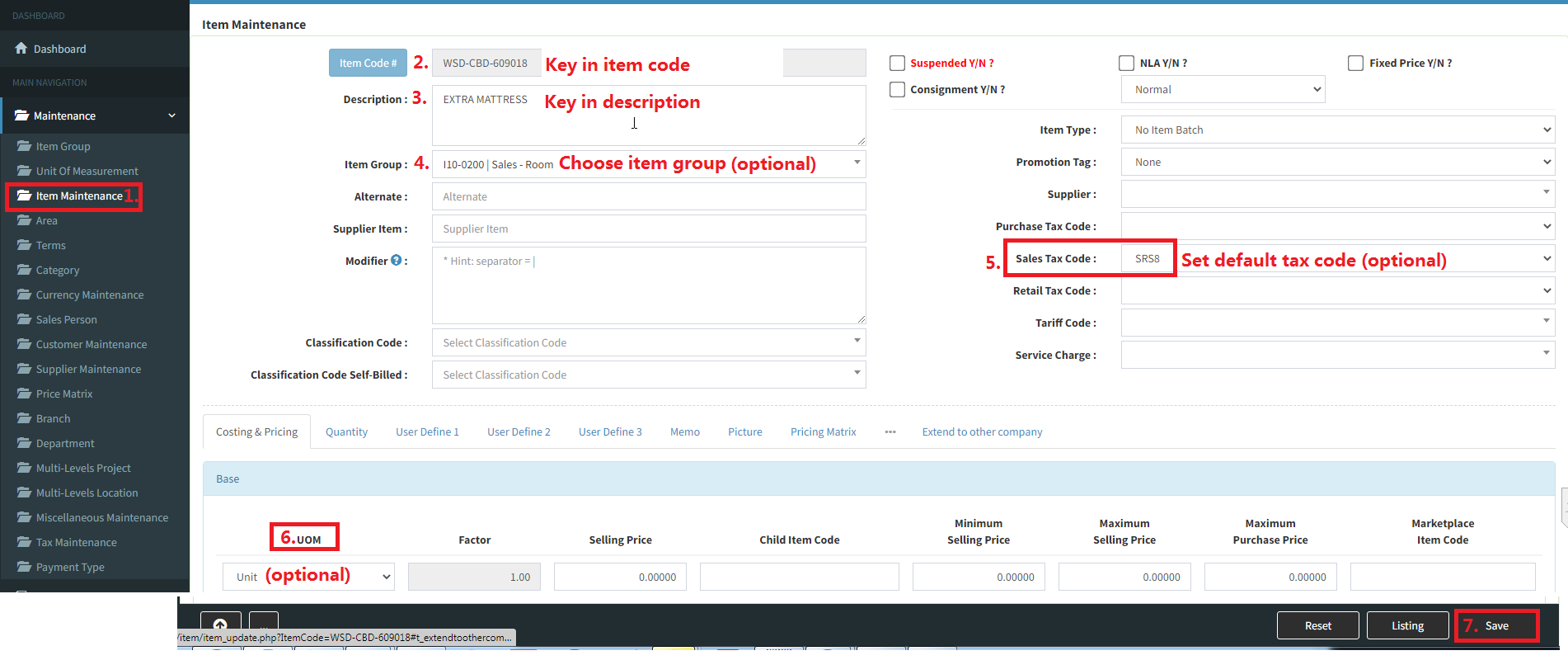

09: Other_If there are any additional charges

Step 01: Please go item maintenance to add [example : EXTRA MATTRESS]

Step 02: Key in item code

Step 03: Key in item description

Step 04: Classify the item under its item group

Step 05: Set default tax code (optional)

Step 06 :Key in UOM

Step 07: Click ‘Save‘