Introduction to SKYBIZ Cash Receipt

A Cash Receipt is an official document issued by a business or organization to acknowledge that a payment has been received from a customer. It serves as proof of the transaction, whether the payment is made in cash, cheque, or electronic transfer. A cash receipt typically includes details such as the receipt number, date, payer’s name, amount received, payment method, and purpose of payment. In accounting, cash receipts are recorded in the cash receipts journal and play a vital role in tracking incoming funds, maintaining accurate cash flow records, and reconciling bank statements. They ensure transparency and accountability in financial transactions, helping both the business and the customer maintain clear and reliable payment documentation.

Reclassifying a cash receipt transaction refers to the process of correcting or changing the original accounting classification of a payment that has already been recorded. This is usually done when a cash receipt was initially posted to the wrong account, customer, or revenue category. For example, a payment recorded as “sales income” may need to be reclassified as “loan repayment” or “advance deposit” after reviewing the transaction details. In accounting, reclassification ensures that each transaction accurately reflects its true financial nature. It maintains the integrity of financial statements by aligning recorded transactions with the correct accounts in the general ledger. This process is especially important during account reconciliation, audits, or financial reporting periods to ensure accurate representation of a company’s financial position.

How to change the payment method or re-classify the Payment on the Cash Receipt?

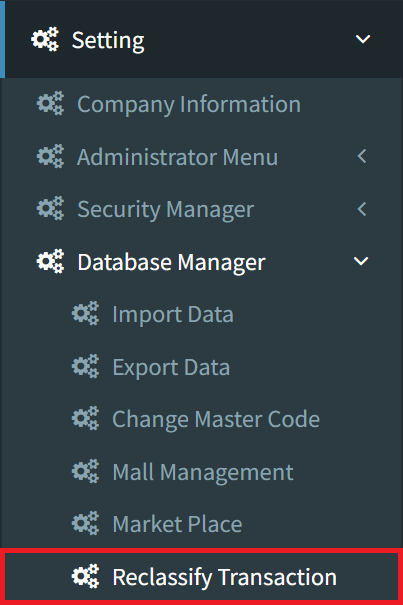

Step 1: To change the payment method or re-classify the Payment on the Cash Receipt, navigate to Settings > Database Manager> Reclassify Transaction

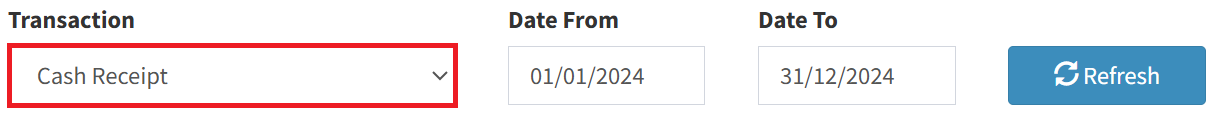

Step 2: Select Cash Receipt as the Transaction type, select the date, then click the Refresh button to view all Cash Receipt Transactions

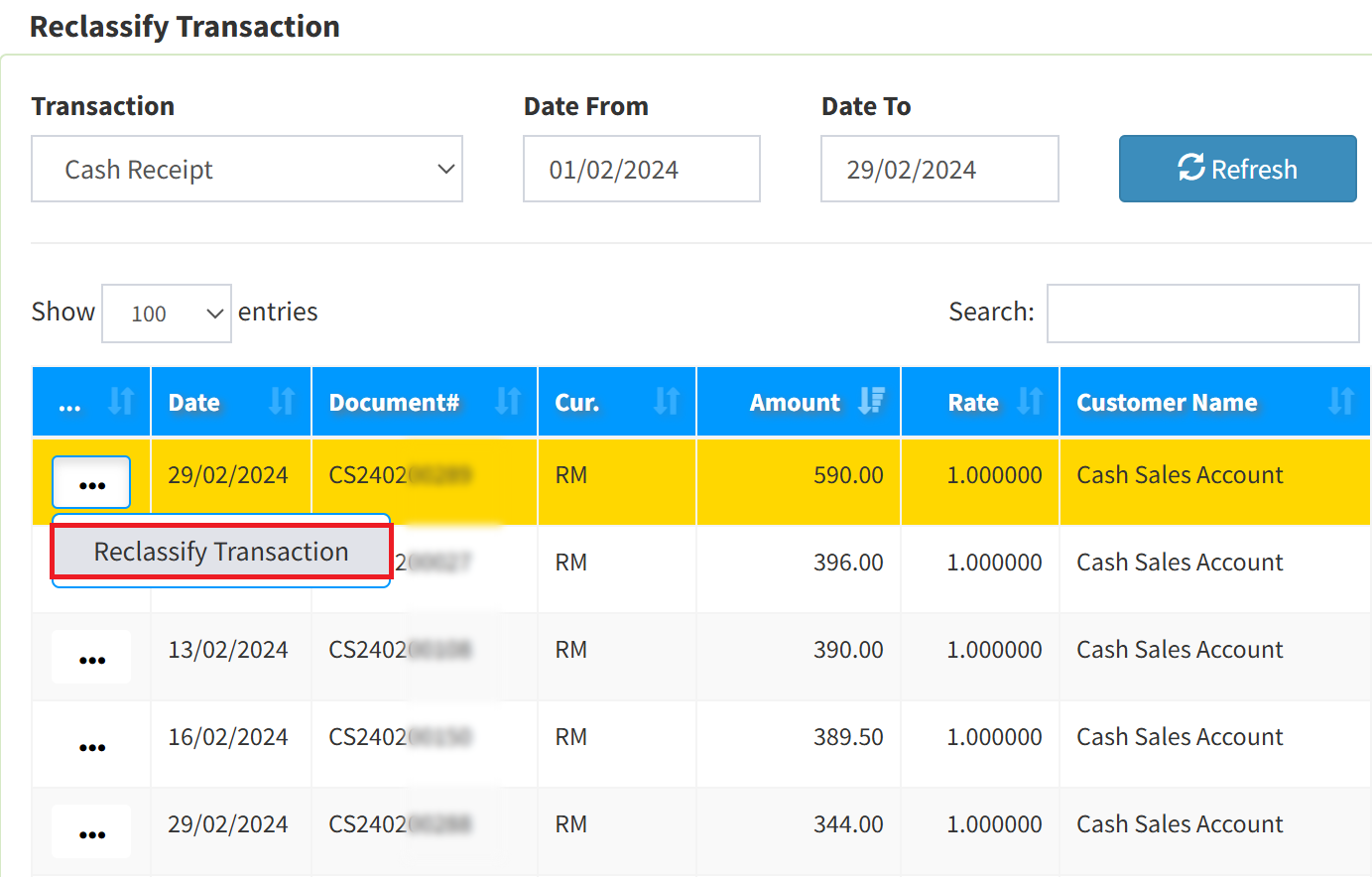

Step 3: Click the 3-dot icon button, then select Reclassify Transaction

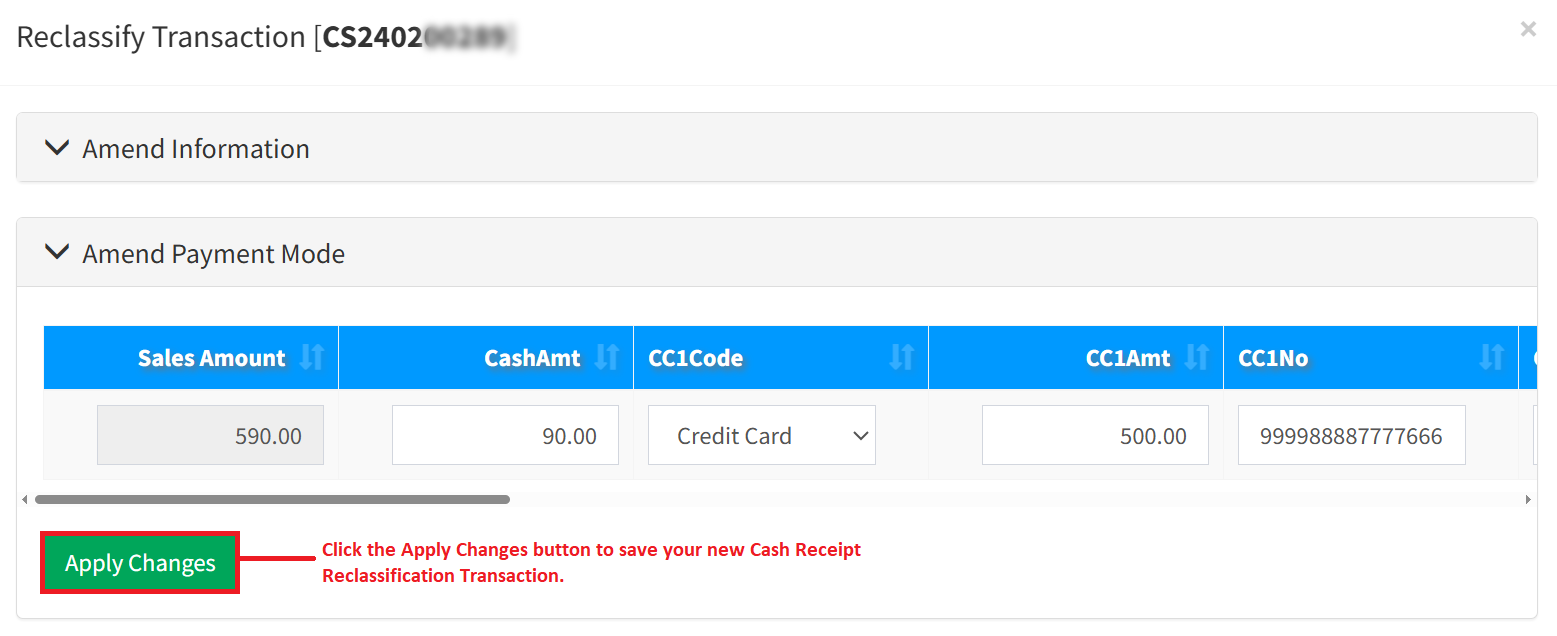

Step 4: Reclassify the transaction by changing the payment method and the payment amount. After that, click the Apply changes button to save the transaction.

Conclusion

In conclusion, a cash receipt is an essential accounting document that confirms the receipt of payment and provides a clear financial record for both parties involved. It supports accurate bookkeeping, strengthens internal control, and enhances financial transparency. By systematically recording all cash receipts, businesses can ensure proper cash management, improve audit readiness, and maintain trust and credibility with customers.

Reclassifying cash receipt transactions is an important accounting adjustment that helps maintain the accuracy and reliability of financial records. It ensures that each payment is properly categorized, preventing misstatements in revenue, liabilities, or other financial accounts. By performing regular reviews and timely reclassifications, businesses can improve financial transparency, support audit compliance, and produce more precise financial reports that reflect their true financial activities.

Powered By: SKYBIZ ®